If you’ve been researching solar recently, you’ve probably come across conflicting headlines about incentive reductions, ITC changes, and whether the “best time” to go solar has already passed. For many Ohio homeowners, this has created real uncertainty around one core question: Is solar worth it in 2026?

The short answer is yes, for many households, solar still makes strong financial sense. But the why matters.

This guide breaks down what actually changed with the federal solar tax credit, how Ohio solar incentives work in 2026, and how homeowners should evaluate solar as a long-term investment rather than a short-term incentive play.

What Changed in the Solar ITC?

The federal Investment Tax Credit (ITC), often called the federal solar tax credit, has been one of the biggest drivers of residential solar adoption in the U.S. since 2005.

A Quick ITC Timeline (High-Level)

- Originally offered a percentage-based tax credit for solar installations

- Extended and modified multiple times over the past decade

- Designed to gradually step down, not disappear overnight

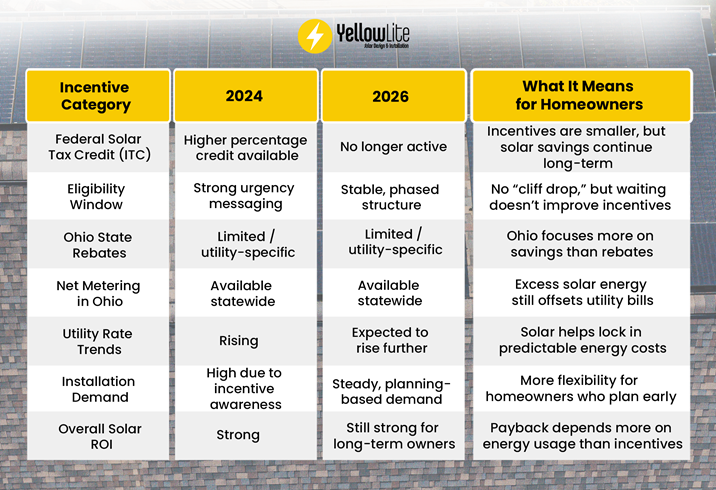

What ITC Changes Mean in 2026

Recent ITC changes solar headlines have caused confusion, but here’s what homeowners actually need to know:

- The credit structure has evolved, but it hasn’t vanished

- Incentives are no longer increasing year over year

- Future reductions are expected to be gradual, not sudden

For homeowners, this means solar is no longer about racing a deadline, it’s about understanding long-term value.

What Homeowners Should Care About

- How much they can save on their energy costs with residential solar panels

- How fast are electric rates going up

- Whether waiting improves or worsens overall savings

Understanding Ohio Solar Incentives in 2026

While federal policy gets most of the attention, Ohio solar incentives play a significant role in determining real-world savings.

Federal vs. State Incentives

- Federal incentives reduce upfront system cost through tax credits

- Ohio incentives focus more on long-term savings through utility structures

Ohio does not offer large state rebates, but it compensates in other ways.

Net Metering in Ohio

Net metering allows homeowners to receive credit for excess solar energy sent back to the grid. In practical terms:

- Your utility bill reflects net energy usage

- Summer overproduction gets credited to your utility account and can help offset winter consumption

- Those credits help stabilize monthly electricity costs

Utility Savings Impact

Ohio homeowners often see value not from rebates, but from:

- Locking in predictable energy costs

- Reducing exposure to utility rate hikes

- Lowering lifetime electricity spending

Is Solar Still Financially Worth It in 2026?

This is where many homeowners focus solely on incentives and miss the bigger picture.

Solar System Lifespan vs Incentive Changes

Most modern systems last 25–30 years. Incentives, on the other hand, affect only the entry point, not the decades of savings that follow.

Even with no solar tax credit in 2026, homeowners still benefit from:

- Long-term energy offset

- Fixed production costs

- Protection from rising rates

Simple Payback Logic

Payback depends on:

- System size

- Electricity usage

- Utility rates

- Incentive structure

For many Ohio households, the payback window remains well within the system’s lifespan, making solar a net-positive investment.

Rising Electricity Costs vs Solar Stability

Utility rates tend to increase over time. Solar allows homeowners to “lock in” part of their energy costs, which is why many still consider solar worthwhile in 2026.

Why Waiting Can Cost More Than Acting

It’s natural to think waiting might lead to better incentives or cheaper technology, but that’s not always the case.

Missed Savings Over Time

Every year without solar is a year of full utility payments. Even modest monthly savings add up significantly over time. For example, if you have a $100 electric bill per month and wait one year to get solar panels, then you will have spent $1200 in energy costs.

Utility Rate Inflation

Over the last 25 years, electric rates in Ohio have gone up 35%. The longer you wait for solar incentives to come back, the higher the rates continue to rise.

Installation Demand Cycles

Solar demand fluctuates with policy changes. High-demand periods can lead to:

- Longer installation timelines

- Higher labor costs

- Fewer scheduling options

For many homeowners, acting based on readiness, not headlines, leads to better outcomes.

To better understand how evolving regulations impact your decision, read Breaking Down Solar Panel Laws: What Every Homeowner Needs to Know before evaluating solar’s 2026 investment outlook in Ohio.

Who Benefits Most From Solar in 2026?

Solar isn’t one-size-fits-all. Certain homeowner profiles benefit more than others.

Ideal Candidates

- Homeowners planning to stay long-term

- Roofs with good sun exposure

- Moderate to high electricity usage

Who May Want to Wait

- Homes needing major roof replacement soon

- Short-term homeowners planning to sell quickly

- Very low electricity consumption households

Understanding your profile helps determine whether solar is the right move now or later.

Solar in 2026 Is Still a Long-Term Investment

Despite changing headlines, solar remains a long-term financial and energy decision, not a short-term incentive play. For Ohio homeowners, the combination of utility savings, system longevity, and remaining Ohio solar incentives means solar can still be a smart investment in 2026.

What’s changed is the conversation: it’s less about chasing incentives and more about making an informed, future-focused decision.

If you’re early in your research, that’s exactly where you should be.

FAQ

1. Are Ohio solar incentives still available in 2026?

No. But Ohio homeowners can still take advantage of net metering and sell their SRECs

2. Is the federal solar tax credit going away?

Yes, the residential solar tax credit is gone. The commercial solar tax credit is still available until the end of 2027.

3. Is solar worth it in 2026 without major incentives?

For many homeowners, yes. Long-term energy savings and rate protection often outweigh incentive reductions.

4. Do ITC changes affect existing solar owners?

No. Once installed, your incentive eligibility is locked in based on the installation year.

5. How do I know which incentives apply to my home?

Incentive eligibility depends on location, utility provider, and installation timing. Local solar professionals can help clarify this.