One of our customers' most common questions is whether they should lease or buy their solar systems. Considering that most solar systems are attached to rooftops and not every home is a forever home, it’s a good question!

In this blog, we will explain the implications of leasing vs. buying and provide you with all the information you need to decide which option makes the most sense.

What Does It Mean to Buy a Solar System?

When you buy a solar system, you purchase the solar panels and equipment associated with the installation.

You incur the upfront cost, which includes solar panels, inverter, batteries (if you opt for energy storage), mounting hardware (if it’s a rooftop system), wiring, and fees.

Once purchased, you own the equipment, meaning you have control over it, including where it’s installed.

What Does It Mean to Lease a Solar System?

Leasing a solar system means you pay a fixed monthly fee to use the solar energy system installed on your property. This option often requires little to no upfront investment. The lease agreement typically includes maintenance and repair services, alleviating the homeowner of these responsibilities.

Under a solar lease, the leasing company retains ownership of the solar panel system.

Why purchase a solar system?

Buying a solar system is a long-term investment.

DSIRE is an excellent resource to check out solar rebates and incentives for every state.

Many states offer property tax abatements and sales tax exemptions on solar equipment. You may also find that your city or county offers rebates as well.

Some states also sponsor solar-specific loans that are a few % points under local banks' lowest rates.

The federal solar tax credit is a dollar-for-dollar tax credit that can cover up to 30% of the cost of your installation.

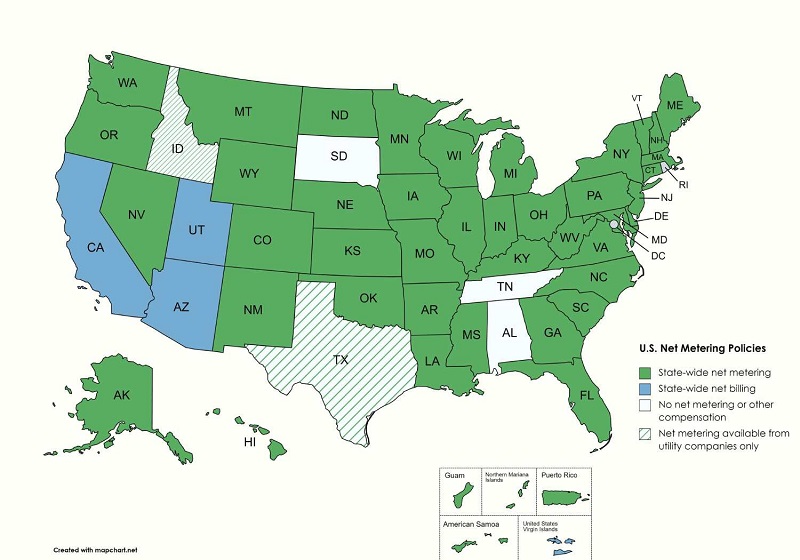

All but three states offer net metering, a billing arrangement that allows you to earn credit for the excess electricity your solar panels produce.

Solar may improve home value

Studies find that nearly 25% of solar-powered homes are likely to sell over the asking price and spend 13.3% less time on the market. However, leased solar panels may not be as desirable to potential buyers because they won’t own them with the rest of the home.

Owning your solar system offers energy independence

Owning your solar system provides energy independence, allowing you to benefit fully from your investment. If you add storage to your solar system, you can produce energy during long stretches of bad weather or blackouts.

Why Choose Leasing?

There are certain situations where leasing can make sense.

When you have limited or no upfront capital

Leasing requires little to no initial investment. Leasing can be attractive if you lack the resources for the upfront cost of buying a solar system.

Uncertainty about long-term commitment

Not every home is a forever home. If you’d like to experience the short-term financial benefits of solar panels but aren’t sure if you’ll stay, leasing might make sense. When you move, leasing contracts transfer to the new homeowner.

No maintenance or repairs

Leasing may be the way to go if you’re looking for a hassle-free solution. Under a leasing contract, the leasing company is responsible for maintenance and repairs. We’ll point out that solar panels are pretty low maintenance.

Limited access to financing or other incentives

If you don’t qualify for loans and your state doesn’t offer many incentives, leasing might make sense.

Remember that if you go the leasing route, the leasing company is eligible for all tax benefits because they own the panels. You may still benefit from net metering.

So, should I lease or buy?

Choosing between leasing and buying a solar system hinges on several personal and financial considerations.

Buying solar panels involves a significant upfront investment, which can vary widely depending on the system's size and specifications. Despite this initial cost, owning a solar system brings substantial long-term benefits. These include savings from reduced electricity bills after the initial investment is recouped, typically within 7 to 10 years, and potential increases in home value. Additionally, owners benefit from various incentives, such as federal tax credits and state rebates. These savings can be considerable over the typical 25-30-year lifespan of solar panels.

Solar panel owners are responsible for maintenance and must consider this in their overall cost assessment.

Leasing solar panels offers a low or no upfront cost alternative, making solar energy accessible without a significant initial financial commitment. Leasing involves fixed monthly payments, generally lower than traditional electricity bills, which continue throughout the lease term, usually 20-25 years. This option relieves homeowners of maintenance and repair responsibilities, as the leasing company handles these. However, it's important to note that leasing does not provide the same long-term financial benefits as buying. Lessees cannot take advantage of solar tax credits and rebates; at the end of the lease term, they don't own the system. They must then decide whether to renew the lease, purchase the system, or have it removed. Leasing offers short-term savings and convenience but lacks the long-term financial advantages of system ownership.

We encourage you to weigh the immediate financial implications against long-term benefits and consider your energy goals and housing plans as you decide.

Get it right with Yellowlite

Navigating the solar system landscape can be complex, but you don't have to do it alone. Contact our pro-solar experts for personalized advice about which option makes the most sense. Let us help you make an informed decision that aligns with your energy goals and lifestyle.