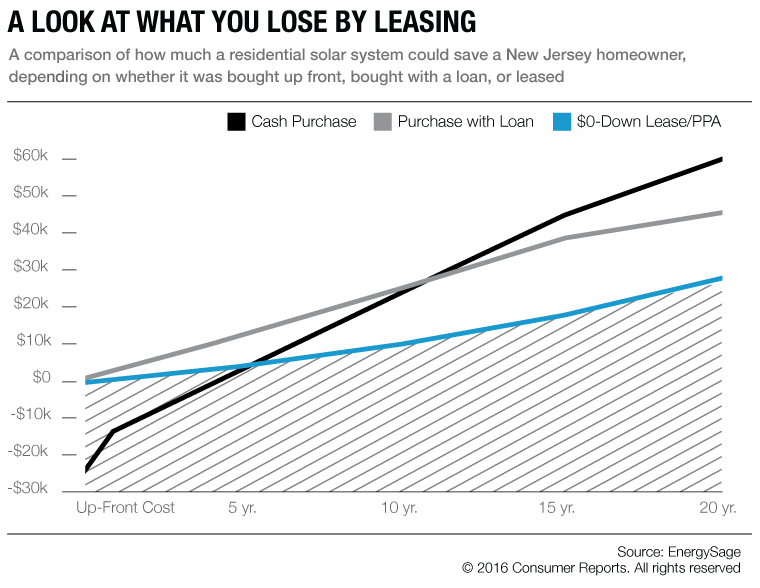

Solar leases far outpaced ownership for the past decade. That has officially changed. As of the 4th quarter of 2016, the majority of the solar market installations were purchased through cash or loan and were not leased by a third party. The significance of this will become more apparent as time goes on. Most of the leases in the solar industry in America took place in California by major leasing companies as they were growing the industry over the past decade. Major companies including SolarCity saw that many people were amenable to going solar but they didn’t want the upfront costs associated with outright purchase.

Paying cash for a solar energy system is generally the best option if you have the money. You lock in the 30% Federal Investment Tax Credit and avoid interest charges from financing the system. You also can anticipate that the solar system will add value to your house if you decide to sell your home in the future.

Taking out a loan to finance your system is the second-best way to go solar. A solar client can take advantage of the 30% Federal ITC and accrue savings off their electricity bill right away. Of course there is a difference between a secured loan and an unsecured loan. With a secured loan, your house acts as collateral so the loan interest rate is lower and you can deduct the interest payments off of your tax liability. With an unsecured loan, your house does not act as collateral and your interest rate is higher.

The least attractive option is a solar lease. You do not get to take advantage of the 30% Federal Tax Credit (the leasing company takes the full amount) and the savings will be modest over the years, usually just a little bit below what you would have paid for traditional electric aggregation. A further downside includes losing control of your roof to the leasing company and having them determine how many panels you need and where they are installed.

Another downside to leasing involves escalator clauses in the lease that increase electricity payments over the life of the system. The real danger in these escalator clauses is that if the cost of electricity increases at a slower rate that your lease payment increases, the homeowner could be in danger of not seeing any economic benefit from the system.

As time goes on and solar prices continue to drop, the leasing option will become less popular. Here at YellowLite we can help a client structure a loan that resembles a lease in all but name, but the client will still be able to collect the financial benefits of owning the system.